SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] Ease of paying taxes law: What you need to know](https://www.rappler.com/tachyon/2023/02/calculate-february-22-2023.jpg)

I am the owner of an online business earning only P1,000,000 per year. Have there been any changes under the Ease of Paying Taxes (EOPT) Law that are beneficial to me and other taxpayers like me?

Yes. The Ease of Paying Taxes (EOPT) law has classified taxpayers into micro, small, medium, and large taxpayers, to wit:

Under the EOPT, your business is classified as “micro.” Consequently, it grants certain benefits to taxpayers classified under the “micro” and “small” group, such as reducing the number of pages from 4 to 2 pages, and reducing the rate of civil penalties. Further, surcharge penalty was reduced from 25% to 10%, interest penalty was reduced from 12% to 6%, the penalty for failure to file certain information returns is now only P500, and the compromise penalty rate of 50% for violation of invoicing requirements.

I am a foreigner with interest in investing in the Philippines. I’ve heard that the EOPT Law has made paying taxes easier. Is this true?

Yes. Under the EOPT Law, taxpayers can file their tax returns online or manually to the Bureau of Internal Revenue (BIR) or an authorized agent bank anywhere in the country without penalty. An authorized tax software provider may also be used for more convenience.

I am a VAT-registered taxpayer, and I find VAT compliance very confusing. Are there any improvements under the EOPT Law?

Yes. There are at least three features under EOPT Law that streamlined VAT rules:

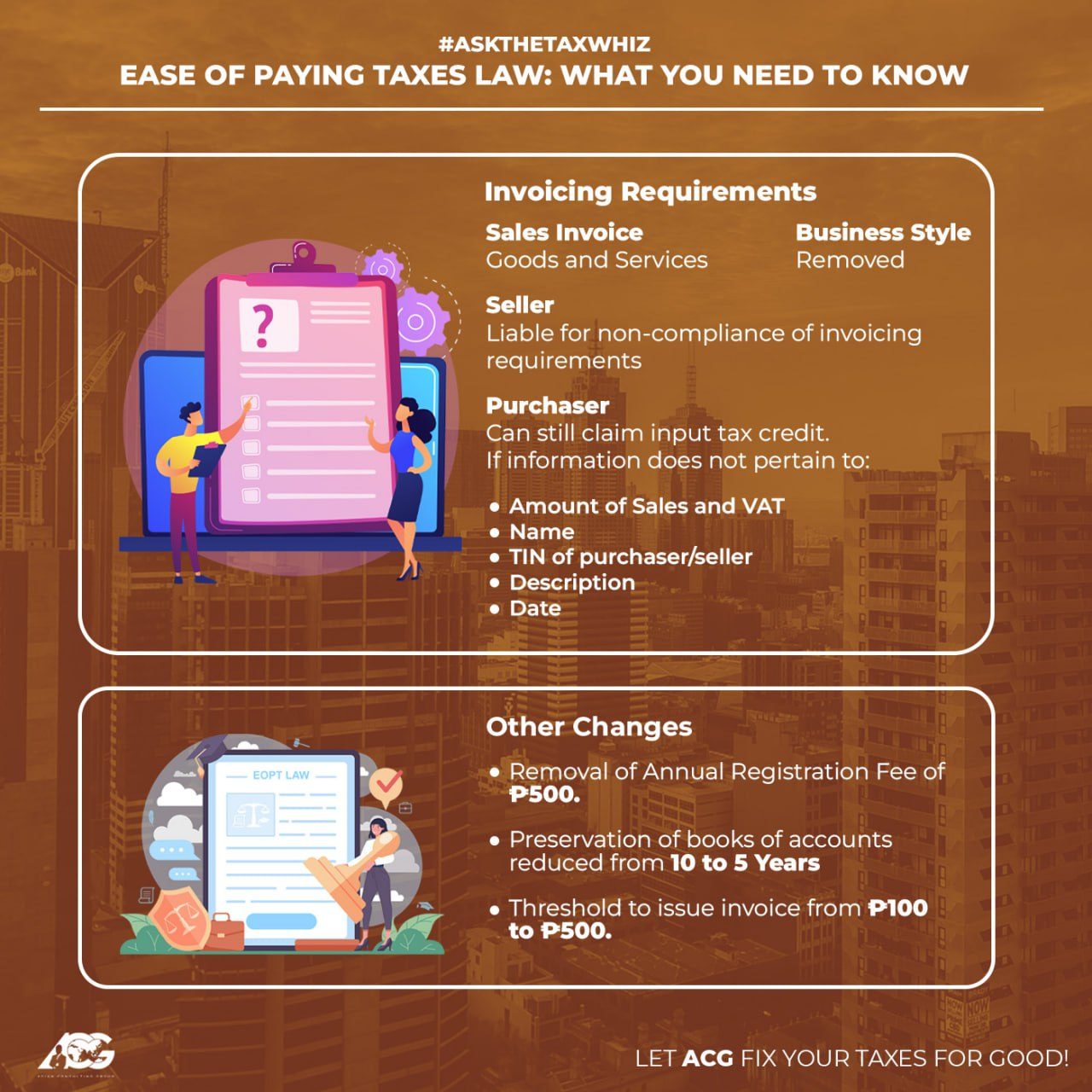

First, a sales invoice is now sufficient for both the sales of goods and the sale of services. Previously, sales invoices were used for sales of goods, while official receipts were used for sales of services.

Second, the EOPT law has allowed output VAT credit on uncollected receivables. If a seller of goods or services has not collected payment for a sale, they can deduct the output VAT related to those uncollected receivables from their next quarter’s output VAT, provided they have already paid the VAT on that transaction.

Third, VAT refund is now risk-based. VAT refund claims will be classified into low risk, medium risk, and high risk based on the amount of VAT refund claim, tax compliance history and frequency of filing VAT refund claims. The BIR must also act on these claims within 90 days, but medium and high risk claims are still subject to audit and other verification processes.

Further, the taxpayers are given a transitory period to adopt the changes in the value added tax within six months from the effectivity of the implementing rules and regulations.

Here are the other features of EOPT Law:

- The requirement to pay an annual registration fee of P500 has been removed

- The period for keeping records of books of accounts has been shortened from 10 years to 5 years

- The threshold for issuing an invoice has been raised from P100 to P500

- The BIR will be adopting digitalization measures

- An online facility to be provided for non-resident taxpayers

To discuss more about the EOPT and other new laws and regulations to improve ease of doing business in the country, the Asian Consulting Group (ACG) is organizing the 2024 International Tax and Investment Conference on February 27 at Sheraton Manila Hotel in partnership with international organizations such as the World Bank, International Tax and Investment Center (ITIC) based in Washington DC, and the Organization for Economic Cooperation and Development (OECD).

Visit www.acg.ph for more information. Avail of the early bird discount. Register here!

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.